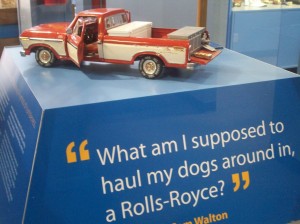

I saw this picture a few years ago and it has stuck with me. I would love to blow it up, and hang it in my office. It is a picture of the replica of Sam Walton’s ( the founder of Walmart) pick up truck, that he drove until the day he died. Sam Walton also wore clothes from his own Walmart, despite dying a billionaire. Love Walmart or hate it, in my opinion, Sam Walton had it right.

There are many traits of highly frugal people that make them successful in life financially, and personally. Warren Buffet still lives in the five-bedroom house in Omaha that he purchased in 1957 for $31,500. Unfortunately many of us, myself included, feel like if we can just make “this amount” every month then I can start saving. When in fact, if I quit spending unnecessarily I would easily reach that magic amount and have something to save.

A bunch of years ago I was pulled over for my registration being expired on my mini van. I kept putting it off because I didn’t think I had the $60 to pay it. As I sat on the side of the road, I pulled my wallet out of my newly purchased $100 diaper bag to hand over my drivers license. How STUPID is that?! Now, I had a $200 ticket on top of everything, completely my fault. I was so mad at the stupidity of it all and swore that something that preventable would not happen again. Things would have to change, I would not live like this, paycheck to paycheck and risk unnecessary tickets, utilities cut off, and MAJOR stress.

I knew that there was nothing at that time that would change the amount of money that was coming home, so I had to work with what was there. It was not much. I was already frugal in nature, but as I thought and prayed about it, I knew that there was more I could do with my circumstances at the time than what I was.

Over the next few weeks, I am going to outline a series of steps that you can take to change the financial situation that you are in. I was your guinea pig, I know that it works. Plus, you get to hear about all the mistakes that I have made and hopefully laugh a little at me and learn something from them! Please share your experiences with what has helped and worked for your family, and maybe what didn’t work so well.

Step 1: Take Charge

Stop feeling sorry for yourself – (I was mostly saying this to me) I had to pull my “crap” together, brush off the pity and put my big girl panties on! I wasn’t going to win the lottery, no one was going to die and leave me a bunch of money, my husband wasn’t going to magically make $350,000 a year. Who cares, I decided I wanted to live happily no matter my income and make whatever we had work to the fullest extent possible.

Take Charge – For the first UGLY time I took a look at what we were spending. I was EMBARRASSED! No wonder we never had any money left at the end of the month. What the heck were we buying all the CRAP for? Done. I had enough, I hate clutter and putting things away, and I wasn’t about to fold extra clothes. We just STOPPED spending. Plus, I started looking at my bank statements everyday. I still do, every single day.

No Excuses – Stop making excuses for spending too much money. Yes, you do deserve it, but you don’t have to buy it. Remember my $100 diaper bag? I had just had my 4th baby, I TOTALLY deserved that bag. I didn’t need it, I should have never bought it, and my baby thought I was awesome without it! The next time you are about to “splurge” or that little voice in your head is saying “don’t buy it” WALK AWAY. Actually listen, and don’t spend the money. If you really want it, think about it for a few days and come back. Most of time you forget about it and didn’t really need it anyway.

Did you have an “ahh ha” moment? What was it? How did you start to change your spending habits?

Part comedian, part Dad, part athlete. He will boss around your children while they play ball.

Part comedian, part Dad, part athlete. He will boss around your children while they play ball. Just as angelic as she looks, this girl could easily raise a Village by herself, and all the children would grow up to be President.

Just as angelic as she looks, this girl could easily raise a Village by herself, and all the children would grow up to be President. Self proclaimed, she would be a webkinz dog. Because, "they're cute, and puppies are too. And they're sweet and they always get along with other puppies."

Self proclaimed, she would be a webkinz dog. Because, "they're cute, and puppies are too. And they're sweet and they always get along with other puppies." This mini-Martha Stewart can handle ANY craft you send her way. She isn't all bows and rainbows, she's got karate kid moves!

This mini-Martha Stewart can handle ANY craft you send her way. She isn't all bows and rainbows, she's got karate kid moves! Not "Pick-Me-Up" like caffeine, she wants you to pick her up! AND NOW!

Not "Pick-Me-Up" like caffeine, she wants you to pick her up! AND NOW! Anything that can be destroyed WILL be destroyed!

Anything that can be destroyed WILL be destroyed! Practically Perfect in Every Way for now! Nicknamed "The Panda" she is rolly polly and lives by the motto, "the little one, is KING!"

Practically Perfect in Every Way for now! Nicknamed "The Panda" she is rolly polly and lives by the motto, "the little one, is KING!" The resident Labradoodle, Miller got his name because Mom won and got to name the baby! Need something chewed up? He'll take care of it. Especially if it's expensive..

The resident Labradoodle, Miller got his name because Mom won and got to name the baby! Need something chewed up? He'll take care of it. Especially if it's expensive..

This post came at a perfect time. My 20-year-old car is on its very last legs. We need to decide if we should put 500$ in it to fix it (when the car itself isnt worth that), buy the 2000$ car that we have the cash for and that will get us by for now, or the 8,000$ car we obviously like the best–its shiny 🙂 After being stranded on the side of the highway with a newborn, and driving in the winter without heat, it’s easy to think “lets be done with this drama and buy a nice car that works!” but i NEED to think “i dont have a job, my husband is about to go on unemployment, and i REALLY want to save up and have another baby soon…”

My parents are “missionaries” here in the states. And so we were always watching our spending. But it didn’t start that way. Whats funny is my Dad used to play in the NFL and got out because he felt the Lord calling him to the ministry. When we were younger my Dad had a nice job in corporate America and we had nice paychecks. Then my Dad got called into full time ministry and that all changed. We weren’t sure where a paycheck would come from and this is when my mom started couponing. But I learned lessons from my parents and learned how to set a budget and save, and coupon. And now that I live on my own it really comes in handy. I always have things on hand and don’t have to run out to the store because I have a stockpile.

I save from every paycheck and from my side job. I love shoes and bags, I just find ways to budget that in. Ross gets designer bags and sells them at crazy prices, so does ebay. I have also found 2 authentic gucci bags at garage sales. I like your tip about walking away. There are times when I can afford things, but I take some time, do some research and see if I really want that item, and most times its a no.

I am not married yet but when I do and when I start having a family I will gladly pass these principles down to the next generation.

My Ahh Ha moment came two years years ago! We had just come back from a wonderful camping trip out west – visiting Mount Rushmore, the Tetons, Grand Canyon and more. It was an awesome vacation – but when we got home and the cc bills came in – it was a shocker $7500 – yep you read right. At that point I swore we would not add anymore debt to our already too much debt. We burned all our CC on New Years eve and swore to pay everything in cash – it has been a hard journey but worth it- we have paid off 6 debts so far and have a way too go. But there is light at the end – the joy of being debt free and no longer living beyond our means- we have had a few hardships along the way but we pull ourselves up and keep moving forward.

You are exactly right! Our ah ha moment came when we needed a bigger home because of a surprise, unplanned pregnancy and then a death in my husbands family. We went from having 3 kids to 5 in about a year’s time! We had our 4th child, and then we took in my husband’s special needs sister after the death of his mother. Our home was jammed packed!! We found a bigger home that would accomodate all of us, but it was more expensive. We realized that if we would quit eating out 3 or 4 times a week, we could afford a bigger home. We put this into action and we were saving about $100.00 a week! Then we started to apply this to other areas of our lives. What could we live without? Long story short, we got a bigger home to house our brood and now we are actually saving money! And now we are saving more because you have taught us how to use coupons! Thanks, Tiffany and Paul! you have impacted our lives more than you will ever know!!!

I am glad you wrote this and to read the responses. It’s Been a rough year with me just having back surgery and unemployment. Now I am trying to regain strength and find a job. Money and the lack of is so stressful! We are so thankful for the all the great deals. I am glad I’m not alone!

Wow I have actually been looking at diaper bags online for my little baby that will be here in a month. That definiatly made me think twice. I really need to get me spending habits in control. Thanks so much!

We have been struggling right along with all of America the past three years. One BIG lesson I have learned is that you don’t need all that junk. We have a great family nigth at home. We own tons of movies since we must of spent our entire savings on them at some point. So Saturday night is family night. We make pizza at home and pull out a movie. We don’t eat out. And I really mean that. The only time we can eat out is a special occasion if the budge allows it. I take my lunch to my new found job after two years unemployed and I bring my own coffee from home to drink on the way, no more buying it everyday (except on Friday, that’s my gift for getting through another week). Its the little things that get you on your budget. I have learned to live for today, prepare for tommorrow. Hope for the best but prepare for the worst.

Judie, I think that is right on! We started playing boggle with the kids and miss it terribly if we skip a night!

The economy changed our spending habits. Like so many other people we were faced with umemployment, short sales, foreclosures…… In the past i had used coupons on and off but in our situation i was forced to use them full time and follow sales. I could not control the economy but i can take control of how much i spend. Our “crisis” turned out to be a blessing in disguise because coupons and sales have enriched our lives. I feel like we have more than before our crisis. We do not own and live in a big fancy house but my pantry is fully stocked, my children received cool presents from santa and with much discipline we managed to pay off our credit cards. My life before our financial ruin seems like a blur. Honestly, i did not take the time to be thankful for the blessings in my life. Now about two or three times a day i am thankful for my children and our health. It really put things in perspective.

Oh wow, thank you so much for taking the time to type that out! You are absolutely right!

I appreciate everyone’s posts. Y’all are inspiring to me. One way I’ve curbed my spending is to just not walk into the store. I prepare my shopping trip very carefully before I even leave the house. When I get to the store I follow my list and if it isn’t on the list, or on a GREAT sale, I don’t buy it. So, when I get home and hubby says, “Where’s the (such and such)?”, I just tell him it wasn’t on the list. (Mostly that I forgot… it wasn’t written down and I just wanted to get home with all the kids without hearing another “Mom can I have this?”). I also ask the kids, “Would you rather have mom at home or have me leave and go to work so you can have this?” I’m usually suprised that most of the time they put it back, give me a hug and tell me they just want me to stay with them… but not always. 🙂

I don’t have a clear ah-ha moment in my head, but I can tell you that I have NO IDEA what we used to spend our money on! When we were first married, we had more than enough money for the two of us to live on, but we never had anything left over at the end of the month for savings. Now that we have children (and make the same $$), own a home, etc, we are able to pay for daycare, diapers, formula, childrens clothes, etc AND still have money to put in to savings each month. It’s amazing what tracking your spending/making a budget does for your finances!

Wow – my moments seem to come more and more frequently. This post really spoke to me. I have a great job- and although I have been fortunate to continue to have my pay increase in a down economy, I always seem to spend what I make and we’re always strapped. I started couponing a year ago. I did great but got frustrated with the time commitment and after getting in a fight with my fave grocery store, I lost it. I am recommitting to getting it all in control because what I DESERVE is to live stress free.

But I’m still not using Suave deodorant. 😉

Since the age of 16, I worked hard and lived within my means which meant saving money came first. When I got my first career job, I was not making enough to live in DC so I only had a box of pancake mix and a big frozen bag of piergoies for food and lived in an apartment with barely any furniture. When I got a raise and started making more money, I fell into thinking that I deserved things because I worked hard. I wasted so much money in those few years eating out and not being frugal, especially with baby purchases. I didn’t know that there was such a thing as couponing until I saw someone on TV right after I had my son 3 years ago. I decided that it would be good to save on some diapers. Now three years later, I get to stay home with him full time and have our household goods budget down to $160 in order to make sure that I can stay home and not use all our saving. Looking back, I wish I could pinpoint something like a $100 diaper bag but I just think that it was a ton of little stuff that added up to $250 in Target everytime I went. Thinking it is little and it won’t matter doesn’t help the pocketbook because it all matters in the budget.

My ah-ha moment came last year. My husband and I always wanted to have a farm. It always seemed out of reach ($12,000 an acre!) so we never really saved because other things always seemed more important because they were “right now”. Last year, my husband’s grandparents told us they would sell us their land for $1000 an acre. GASP! All of a sudden our $27,000 a year seemed like more than enough to save. We are now able to save $500 a month that used to “not be there” and still pay every bill, make our truck payments and provide for our 1 year old. We live in a 5th wheel R.V. to help us save up and that was SOOO NOT easy. It gets cramped and we are just ready to pull our hair out sometimes… But… we are only 22 and ready to pay cash for 10 acres to start our farm and are now working on the house. All it takes is getting your priorities in order. Thanks so much for all the savings tips! You make saving so much simpler.

Oh what a wonderful goal! I am so jealous! You have an amazing story and to be so young, great job!

I never even saw this post because it was buried on the third page… I was going to look back and find the enfamil coupons…

Make it go to the front! This really helps an dmakes sense. It gives me the oomph to really track our spending

Our ah-ha moment was when we were trying to make a budget. We wrote out all our bills first and subtracted them from our income. We were surprised to see that we should have an estimate of anywhere between $800-$1,000 in overage after all our bills were paid each month. We both looked at each other and said why are we struggling so much paycheck to paycheck? (It was recalculated several times.) Then we went to the bank statements. Wow were we surprised how much late fees and nsf fees as well as eating out really added up. To make matters worse we didn’t even coupon then. Since the change ( Thank you Tiffany and Paul my go to couple for deals) We are finally able to pay for unexpected expenses and still able to go out to eat about 1 or 2 a week. Of course we usually only go out to places that have a kids eat free deal or 2 can dine deals but it still is much better than the stress of debt. I have built a passion for couponing; because of the joy of saving money and the ability to enjoy a more meaningful as well as memorable life with my family. I also have had the chance to give back in our community which at one time was helping my family and I. It is a true blessing and honestly you and your husband helped make that possible for my family through your blogs and helpful tips. For that we are truly grateful. Thank you once again 🙂

My “ah ha” moment really wasn’t about starting couponing, but rather decreasing the couponing that I currently do. I recently dropped out of college because I wasn’t enjoying it, and my grades were pretty bad…okay, horrible. There are so many great deals out there, that I let them run my life. Rather than doing my homework and studying, I was clipping coupons and searching for great deals. Getting free toothbrushes and shampoo is great, as long as you can use them. I am now living at home with my parents who have told me that I have six months to find a job before they kick me out. I have student loans coming up in less than six months and very little money. Looking at all of the purchases I made I realize that most of the things I didn’t really need or even want for that matter. I’m 21 and single. Why was I buying men’s body wash? No one in my family even uses it. Plus, my parents were still paying for food/toiletries. There was no point in me spending time/money buying it. Don’t get the wrong idea here, couponing is a great way to save money. Just make sure that you don’t let it get your priorities out of whack.